Let’s talk about what’s been going on at Coinbase

Tonight I hopped online to ask one of my oldest friends, a quick question about a project we have been working on together. I asked, he answered and overall, it was pretty mundane. The conversation then shifted, and he asked me about Bitcoin, and more specifically Coinbase. Cue mysterious music, because I didn’t quite understand what he was asking me at first, since we were typing back and forth rather than actually speaking directly.

To sum it up, the conversation went something like this,

“Hey man, what happened with Coinbase? I saw they shut down trading today during the plummet.”

I chuckled and said “Yeah, they were having some issues today. Their CEO is either incompetent or an active enemy of Bitcoin. They should call it Failbase. I’m starting to believe he is an enemy and not just a common idiot, the way they launched the bcash trading kind of sealed the deal for me.”

He proceeded to tell me about how he just purchased his first little bit of Bitcoin, and how he was feeling good that he bought the dip. He bought $115 bucks worth.

I wish I would have known about this before it all happened, but you know how it is, I don’t like to speak to people about when I’m making transactions either. He goes on to tell me that he withdrew it to his green address segwit wallet, that I told him how to setup a few days back. I felt pleased I was able to help him out and get him started off right.

This is the kicker, he didn’t know that you can transfer your Coinbase balance to GDAX for free, and send it from GDAX with no fee. I felt terrible cluing him in, the following sentence after he just finished telling me he had to pay $45 in withdrawal fees, and that after all the fees, only $70 had actually made it to his wallet.

That must sting, to have that be your first experience with Bitcoin.

Luckily, like I said, we’re old friends, been through some ups and downs together, so he listens to me. I had to break the situation down for him.

- Bitcoin has a problem with scaling, but there is a solution on the way, and it’s in beta testing right now. It’s called the lightning network

- The network is bogged down with too many transactions due to the popularity caused by the media and price action.

- Coinbase until very recently has resisted pressure about implementing segwit which reduces fees

- Next time use the free withdrawal via Coinbase’s sister company GDAX.

- Contact other services and companies you use and request they upgrade to segwit.

I then began to recap a flurry of tweets I had been following today from @WhalePanda & @LaurentMT.

Is Coinbase the next Mt. Gox?

It seems LaurentMT has uncovered evidence that Coinbase may have a serious problem.

For example, this entity (https://t.co/wyTt53e0aX) is a wallet controlled by Coinbase. To date, it owns around 203 BTC split in 1,464,545 utxos !

With BTC at $15.8k, it means $3.2M with an average utxo value of 2.2$. #DustInTheChain— LaurentMT (@LaurentMT) December 20, 2017

Ok, I’m not the most technical person so basically the significance of this little morsel of information was lost on me. Thanks be to Whale Panda for his awesome work in making this foreign tech-speak into a wonderfully eloquent, and simple summation.

If the majority of the people would withdraw their #Bitcoin, they're going to have to make people pay either insane fees or buy #Bitcoin on other exchanges to cover their losses on consolidating their utxos.

— WhalePanda (@WhalePanda) December 22, 2017

Since many people don't seem to get the implications of this and to make it more sensationalistic: TLDR; @coinbase is basically running fractional-reserve for #Bitcoin. They might be able to cover it with other assets though. https://t.co/axtauJvmwp

— WhalePanda (@WhalePanda) December 22, 2017

Now, this struck me as very interesting. It seems they may be trying to push the new shitcoins being added to their platform, to generate a bunch of new fees, to make up for the loss of these improperly stored Bitcoin, discovered by LaurenMT. This would allow them to make up the funds they have issue with. This would also mean bank runs on Coinbase are possible. Let that sink in, for a moment.

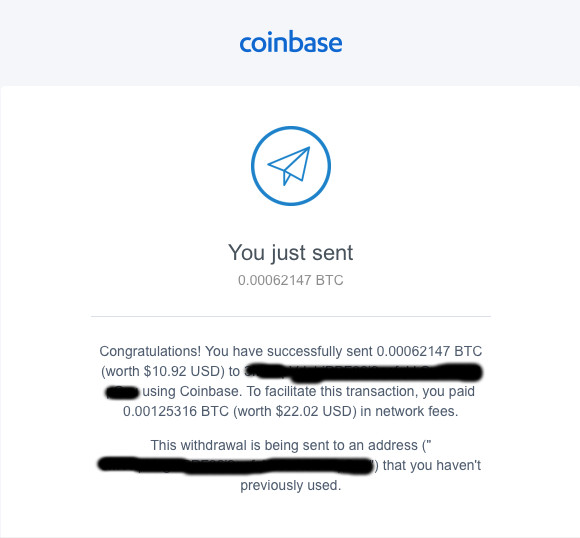

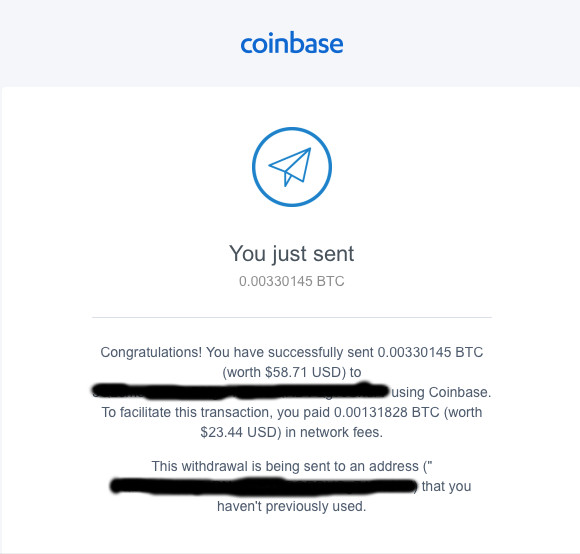

My friend told me that what really rubbed him the wrong way about his Coinbase experience, was that when he was was withdrawing, the Coinbase site kept telling him he didn’t have enough funds to send. He tried it several times and it finally went through, for the amount of $10.92 ( not the whole amount of the balance in his wallet, like he was trying to send) and it charged him a $22 transaction fee. He had to send a second transaction and pay a second fee, also over $20. He insists he didn’t choose this amount, he chose the whole amount, and that Coinbase glitched out and this is what he saw when the transaction went through:

This forced him to make this second transaction, and get charged fees twice:

I know my friend.

He is a smart guy, and despite being a noob, I believe him when he says he didn’t accidentally send this transaction in this amount. I have known him to be competent and I did a pretty thorough job explaining to him how to use the site to purchase. (I just never got around to explaining the part about the free withdrawals on GDAX, because he hadn’t yet purchased BTC when we spoke previously.)

Take this as an anecdotal story, that has a strange correlation with Whale Panda’s summation, and perfect timing. Is my friend one of many victims of Coinbase covertly causing the fraudulent charging of additional fees to make up the loss in their books?

Either way, the point is Coinbase (and a lot of other companies) need to stop dragging their feet and start embracing segwit, because there is no reason to be suffering these high fees when a way to alleviate the issue exists, and is already released, and simply is not being used.

All of these companies in the space, supported segwit 2x, but they can’t support segwit? Um, Right…

Let’s Really Talk About Coinbase

Coinbase claims to be the world’s largest Bitcoin exchange and it operates in over 30 countries.

Coinbase markets itself as an industry leader and an easy gateway for noobs to buy and sell crypto. They are media darlings, and they have been having exponential growth, due to the recent spotlight on Bitcoin in mainstream media coverage and the hype fueled by the wild swings in price.

This combined with their cozy banking relationship allow them to offer service in many countries without a competitor. They do have a pretty good interface that’s intuitive for beginners. Lately they have been signing up to a 100,000 new accounts per day. By all measures and standards, Coinbase has been a tech startup grand slam.

So why does the crypto community always cry foul when it comes to Coinbase? I mean if they were really so great, we should be singing their praises right? Why is there so much venomous hatred for Coinbase, their policies, and their CEO?

For starters, Coinbase is wholly owned and operated by the banksters and rich fat cats, that we in the crypto community are currently trying disrupt. They have a rigorous AML/KYC process, which requires you to submit a bunch of intrusive information, which they have to approve. The app that does the analysis is notorious for being really frustrating to use. AML/KYC is pretty much in direct contradiction to the ideals of financial freedom and privacy that much of the crypto space passionately believes in and works very hard to defend.

Welcome to 1984 (in 2017)

Coinbase actually goes so far as to employ blockchain forensics to track customers and their purchases, after they have moved their funds off the exchange. Not only do they straight up spy on you, but they will pull some really shady maneuvers, and block your account and freeze your funds, if they don’t like how you are spending your own money, in your own life, in a manner that has absolutely nothing to do with Coinbase.

I have heard of them arbitrarily shutting down accounts for such reasons as going to a Bitcoin gambling site, a porn site or purchasing something on the dark web, or using coins that other people have used for gambling, porn or the dark web, sometimes you accidentally trigger their algorithm and they freeze your account for no reason at all.

Obviously the attempts to track you and freeze your funds for reasons that may not be clear at all, is very frustrating. Then there is the insulting way that they will attempt to make decisions for you based on their morality, about what you’re allowed to buy with your own funds. When you add this arbitrary application of their policies with wild inconsistency, to their absolutely horrible customer support, you will understand why there is so much negativity towards Coinbase.

There is nothing more hated than a large institution that wants to cause you a long drawn out hassle to access your own money. The web is full of Coinbase customer horror stories. It has gotten so bad that people regularly make their issues public on social media, because Coinbase actually responds to their support tickets when it makes them look bad on Reddit or Twitter. If you complain in silence they simply ignore you. I should include that they have recently added phone support and claim to have hired several hundred customer support employees recently.

Coinbase also apparently ripped off a bunch of their affiliate marketers, by not honoring the affiliate program terms and conditions and not paying the agreed upon amounts. They have tried to patent a bunch of blockchain technology that they didn’t invent or develop or even contribute to. They have actively tried to undermine Bitcoin by supporting every hard fork, on the opposite side of the majority of the Bitcoin community. They have promoted altcoins, instead of Bitcoin, and Brian Armstrong the CEO of Coinbase, has come out on various occasions saying he owns Ethereum, over Bitcoin. They supported both Segwit 2x and Bitcoin Classic.

As Tone Vays famously put it, “They are always on the wrong side of every issue facing the Bitcoin Community.”

This has been especially true this week.

What Have They Done For Me, Lately?

First, Coinbase caused a market uproar, by releasing Bcash trading with no prior warning, save for an alert that went out one our before.

This caused an absolute frenzy which forced Coinbase to shut down Bcash trading, just 4 minutes after it began. By the time they shut it down, Bcash had risen to over $9,000. This was a ridiculous price difference in comparison with every single other exchange, which had Bcash priced around $3,500.

Everyone was blown away by what had just happened and by how quickly it all occurred. Twitter sparked to life and we soon had thousands of crytpo-citizen crowd investigators on the case. What they found was pretty alarming.

It began a few days before all of this, when Bcash volume started to pick up and the price began rising inexplicably. Then a couple days later Emil Oldenburg, the co-founder of Roger Ver’s website Bitcoin.com (which has recently been more widely recognized for Bcash), publicly came out in the Belgian press and proclaimed he had sold all his bitcoin because it’s unusable, and has switched instead to Bcash.

Then on December 20th, Coinbase sent out their alert that they were going to be opening Bcash trading in an hour, in the early afternoon.

This was a break from their roadmap, and contradicted the information published on their website which said they were offering withdrawal only of Bcash in 1st quarter of 2018 (not trading). Around the same time all this was happening CNBC’s twitter account began agressively tweeting pro Bcash tweets, and responding sarcastically to people on Twitter, who were asking if the account had been hacked due to it’s complete lack of professionalism, and seemingly out of character nature of the comments. Roger Ver was scheduled to speak on CNBC that afternoon, about Bcash. Can this all be just an amazing set of circumstances tied together with the same kind of lucky odds that led to the evolution of multi-celled organisms arising from the proverbial primordial soup? Or can something far more sinister, and a lot less driven by chance and coincidence, be at play here?

Whale Panda looked into it further and found out that:

Meet Gaby Wasensteiner. Gaby probably loves Paul. But she also definitely loves BCash. Gaby happens to work for CNBC, more specifically she is Marketing Manager. pic.twitter.com/0pchbArWPs

— WhalePanda (@WhalePanda) December 20, 2017

Et, Tu, CNBC Fast Money?

Once people started realizing that this had been a well planned and coordinated attack on the Bitcoin network by Coinbase, CNBC Fast Money, and Roger Ver’s Bcash camp, and that insider trading had most likely taken place, they became angry.

It suddenly dawned on everyone that Coinbase had front run the market against their own customers. A bunch of people started tweeting that they were going to report Brian Armstrong (CEO of Coinbase) and Coinbase to the authorities for insider trading. The only thing is, in the crypto world there is no such thing as insider trading, so like it’s like the movie Ghost Busters, “who you gonna call?”

The reaction from Coinbase customers, reminded me of Rico, in the movie Belly.

People on twitter, filing reports to the S.E.C. about Coinbase.

source: Thompson-Reuters, lol.

All this talk of the S.E.C., insider trading, and investigations, must have hit a little too close to home because Brian Armstrong, quickly issued a panic induced public statement saying Coinbase would hold their own internal investigation into the matter to see if there had been any wrongdoing taking place. Naturally this was met with a less than enthusiastic response from a very skeptical public. It’s like the fox coming out publicly to investigate the wrongdoing that occurred in the hen house. Either way, it ruffled enough feathers, that Coinbase felt they had to issue a statement as a sort of pathetic damage control measure to try to repair the destruction of their image. Hilarity ensued.

An example of Tweets, threatening complaints filed to the SEC, about Coinbase:

Things are about to get real @rogerkver @coinbase @GDAX. All documented and submitted. Your 2018 forecast is looking bad. ??

CC: @SEC_Enforcement @SEC_News pic.twitter.com/vVbFKUIuP9

— The Litecoin Queen [ŁTC] (@CryptosQueen) December 20, 2017

If we had to guess about public sentiment, we could always refer to this poll:

Will @coinbase get hit w/ insider trading charges by the SEC?

— exiledsurfer (@exiledsurfer) December 20, 2017

Can There be Consequences in an Unregulated Market?

Many of us recognize Coinbase for what it is and view it as a necessary evil to onboard new Bitcoin users. We use it to navigate back and forth bewteen the crypto and fiat worlds, as for many people around the world it’s the only reliable option to get Bitcoin. It’s also one of the few options for many people that allows direct fiat currency to crypto conversion/exchange. So it really sucks that they price gouge on fees, actively try to undermine Bitcoin while promoting shitcoins (although we now know why), and generally try to do everything they can to make life more difficult for their customers. I cannot wait until the market begins to provide competition, so these companies like Coinbase and Xapo that want to be a trusted 3rd parties in an industry trying to eliminate trusted 3rd parties, can finally die a slow and painful death. We don’t need Bitcoin to become Paypal 2.0.

Since the crypto markets are unregulated for the most part, there is not as many stringent rules about what is and isn’t legal. Crypto as a whole has existed in the gray market, and black markets for much of infancy, and it being taken seriously by the finance world is a very new development. They have been too busy going through the other steps outlined by Ghandi, namely laughing, and ignoring. Even this year a bunch of shills have publicly made the statement that Bitcoin is only used by terrorists and drug cartels, Jamie Dimon being one of the more infamous idiots to make this statement.

The lack of oversight is seen as a blessing by freedom advocates and libertarians and is decried by newer members to the community that do not share the same cypherpunk worldview espoused by so many of the early Bitcoiners. Whatever your view on the issue may be, it has allowed scammers and criminals to participate in the crypto economy just like everyone else.

This has lead to many in the Bitcoin community to advocate policing itself, by voting with our BTC. It’s simple, boycott businesses that harm the community, and support those that help the community. Until this week, even though Coinbase was seen as an inconvenient way to buy Bitcoin, it wasn’t seen as a company that was working against Bitcoin. This has all changed now. After the fiasco they have pulled with Bcash, many in the community are withdrawing their support and migrating their business over to Gemini

Gemini is owned by the Winklevoss twins that where made both rich and famous when they sued Mark Zuckerberg of Facebook fame for stealing their idea to use as the foundation of Facebook. They were awarded a multi-million dollar settlement which they used to become the largest private owners of Bitcoin, and the first Bitcoin Billionaires. Overall they have been far more supportive of the Bitcoin community, and are working for it, not against it, unlike Coinbase.

6 in the Morning, Police at My Door, Fresh Addidas Squeek Across the Bathroom Floor

Apart from consequences of angering a grass roots customer base of ideological activists, that will withdrawal their support, there isn’t much else that can be done. Or is there?

Twitter user I am Nomad thinks there might be:

hey @coinbase , @GDAX and @brian_armstrong by being part of a product index for @CMEGroup you agreed to certain rules. Since bch news was clearly leaked around 2:30pm CST to certain parties. this qualifies as insider trading. Hope you enjoy the incoming complaints.

— I am Nomad (@IamNomad) December 20, 2017

OMG! The CME! I forgot all about Coinbase and their involvement with the CME. Oh boy! That’s more than an invite for the feds to kick in your door. That’s like painting a day glow target on your back with a neon sign on your head that says “prosecute me”. Wow!

Bill Duke, always gets the truth!

Apparently I am not the only one who thinks this because earlier this morning when I was on twitter, I saw what is purported to be a leaked document from the S.E.C. I have no way to prove the authenticity of this document, although it does look official. My mom is a stenographer so I recognize the format as standard for a legal deposition, or testimony. If they really were taking a statement in a legal proceeding, it would be in that format. Whether it is a real document filed by an enforcement arm of the S.E.C. remains to be seen.

Thanks to Cryptosurfer for retweeting this, for us.

You know I love a good cut and paste. Better buckle up for this one #btc #bcash #sec #coinbase @LDTmike pic.twitter.com/GWkfvWek1q

— Cryptosurfer (@StewartWebb12) December 22, 2017

Has Coinbase Actually Gone Too Far?

At this point what we actually have is a lot of damning circumstantial evidence of what may be a serious crime (or non-crime), that may be being actually investigated by real investigators. William Mallers the father of lightning network developer of the Zap wallet, Jack Mallers, has been involved with the CME his whole career and his father (Jack’s grandfather) was the Chairman of the Chicago Board of Trade. He has been giving his expert perspective on all things that have to do with the futures markets, and has been a leading commentator about this issue with Coinbase and the possible insider trading/manipulation with the CME futures markets.

He recently tweeted this about the CME and what could play out, if the insider trading turns out to be true, and the ramifications of it.

7/CME knows it MUST protect the integrity of its products, if 1 of 4 firms that makes CME btc index, is working against btc …confidence lost

— willb20 (@willb20c) December 20, 2017

Jack Mallers expanded on this a little bit, in his recent interview with the Block Digest Podcast. He makes the point that Bitcoin has been struggling to actually be taken as serious and legitimate asset class, and breakaway from the bad reputation it’s been given due to it’s early adoption by the dark web, and the constant propaganda repeated about how only criminals and terrorist use it, that has been promoted by the media and law enforcement.

For a prestigious major financial institution, like the CME or CBOE, to actually offer a financial product based on Bitcoin, it’s a huge deal.

It’s also a major step for the progress of Bitcoin’s mass adoption. For Coinbase to actively be providing price index data to the CME, while directly undermining the success of that derivative product, and the confidence of the futures market itself, is not only an egregious financial crime, but also a huge, huge step backwards for Bitcoin adoption as a whole. The fact that they would launch Bcash trading in such an irresponsible manner, and in such a conflicted fashion, with so much riding on the line, speaks volumes about the competence of Coinbase’s leadership.

This isn’t even taking all the other accusations of malfeasance and sheer amount of overwhelming complaints about their past decisions, lack of customer support, political meddling and the fact that they track and spy on their users, or the fact that they may have been so stupid that they made themselves insolvent by incompetently storing their Bitcoin.

Where do We Go From Here?

It’s time we send Coinbase and every other business in Bitcoin/Crypto a clear message from the community, that companies that behave in this manner will not receive community support, and that they will be boycotted. I can’t wait to watch and see what happens with any possible prosecutions, it will certainly be entertaining at the very least.

This post will serve as a warning to all the companies in the Bitcoin space, putting their fiat profits above the Bitcoin community.

We will not tolerate this shit. We will not forget who you are, and we will withdraw our support if you cross us. We don’t need you, you need us. Every company that supported the contentious forks over BTC is already on thin ice, keep playing with fire, and see where it takes you. We are no longer going to play nice. The gloves are off and we are playing for keeps.

This is Bitcoin, and winner takes all, remember that. What is at stake here is the financial freedom of humanity, or it’s final enslavement.

Like the saying goes, there is never a boring day in Bitcoin

2 Comments

BestFlorrie · May 8, 2018 at 2:37 pm

I see you don’t monetize your site, don’t waste your traffic, you

can earn extra bucks every month because you’ve got high quality content.

If you want to know how to make extra money, search for:

Ercannou’s essential adsense alternative

Ricardo · October 29, 2018 at 9:47 pm

thanks, i’ll check it out. I have just started playing around with this project again. About to actually put effort into making this site much better